An equity-linked investment (ELI) is generally a short to medium-term investment product. In addition to this potential interest, the payoff would be determined by the performance of reference stock(s). Generally, ELI could be one of the investment tools to enhance returns when investors hold relatively stable or moderately bullish views on reference stock(s).

Investment period: 2-11 months

Investment currency: HKD, USD, RMB

Reference underlying(s): Linked to a Single stock or a Basket of stocks

Flexible investment period and Low entry threshold

ELIs flexible tenors range from 2 months to 11 months, and the entry threshold is as low as HK$100,000.

Higher potential returns

The investment returns are linked to the performance of the underlying equities. Compared to time deposits, Investors have the opportunity to earn higher potential returns than fixed deposit interest rates.

Early call feature

An ELI with an early call feature will be terminated before its maturity date if the closing price of the reference stock(s) on a call date is at or above the pre-determined call price.

Physical settlement

If the reference stock closes below the strike price at final fixing date, the investor needs to buy the stock at the strike price.

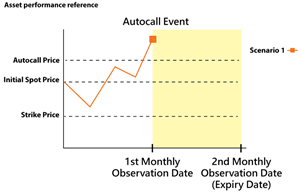

If closing price of Stock A is at or above the Autocall price on the observation date, then the ELI will be early called.

Investor will receive

▸ A full redemption of the invested amount

▸ The potential coupon amount up to the call date

Example

ELI is terminated one month after the issue date and investor receives invested amount (100%) and coupon (1%)

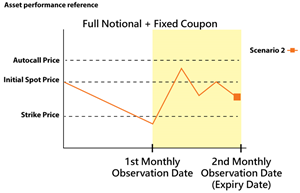

- An Autocall Event does not occur

- If closing price is equal to or above the Strike price on the Expiry Date

Investor will receive

▸ A full redemption of the invested amount

▸ The potential coupon amount

Example

ELI is matured and investor receives invested amount (100%) and total coupon (2%)

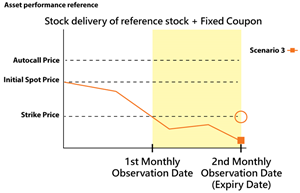

- An Autocall Event does not occur

- If closing price is lower than the Strike price on the Expiry Date

Investor will receive

▸ Delivery of Stock A

▸ The potential coupon amount

Example

ELI is matured and investor receives delivery of Stock A at strike level (90%) and total coupon (2%)

If you would like to know more about the product risk ratings or your investment risk preference, please contact your Relationship Manager or our 24-hour InvestLine (852) 2878-5555.

Since ordinary dividend is not an extraordinary unforeseeable event and issuers would include relevant factors in the quoted price of equity-linked investment (ELI), no adjustments will be made on the ex-date.

As for special dividends, subdivision or consolidation of the reference stock, a bonus or rights issue, the issuer (as the calculation agent) would be acting in good faith and a commercially reasonable manner to preserve the economic equivalence of the relevant ELI.

Please note that all adjustments are subject to the issuer's announcement.

However, if the typhoon is lifted during the day and the exchange resumes trading in the afternoon, the observation of the early redemption and expiration date will remain normal.

Please note that all adjustments are subject to the issuer's announcement.

When an investor purchases an ELI, he is indirectly writing an option on the underlying shares. If the market moves as the investor expected, he earns a fixed return from his investment which is derived mainly from the premium received on writing the option. If the market moves against the investor’s view, he may lose some or all of his investment or receive shares worth less than the initial investment. When choosing an ELI, you should also note the followings items

– form your own view on the reference asset(s)

– understand the features and risks of different ELIs

– note the fees and charges involved. For example, if you take physical delivery of shares on expiry, you will have to pay stamp duty, transaction levy, registration charges and other expenses

– choose ELIs that match your view on the reference asset, time horizon and risk tolerance level

– refer to the ELIs terms and conditions about actions which can be taken by the issuer in case of an unforeseeable event

You may refer to The Chin family’s web site for more information : https://www.ifec.org.hk/

ELI is a complex product and you should exercise caution in relation to the product. This is a structured product which may involve derivatives.

Equity Linked Instruments (ELIs) are structured products which are marketed to investors who want to earn a higher interest rate than the rate on an ordinary time deposit and accept the risk of repayment in the form of the underlying shares or losing some or all of their investment. When an investor purchases an ELI, he is indirectly writing an option on the underlying shares. If the market moves as the investor expected, he earns a fixed return from his investment which is derived mainly from the premium received on writing the option. If the market moves against the investor’s view, he may lose some or all of his investment or receive shares worth less than the initial investment. Investors may lose part or all of their investment if the price of the underlying security moves against their investment view. Investors are exposed to price movements in the underlying security and the stock market, the impact of dividends and corporate actions and counterparty risks. Investors must also be prepared to accept the risk of receiving the underlying shares or a payment less than their original investment. Investors should note that any dividend payment on the underlying security may affect its price and the payback of the ELI at expiry due to ex-dividend pricing. Investors should also note that issuers may make adjustments to the ELI due to corporate actions on the underlying security. Investors should consult their brokers on fees and charges related to the purchase and sale of ELI and payment / delivery at expiry. The potential yields disseminated by The Stock Exchange of Hong Kong Limited have not taken fees and charges into consideration. While most ELIs offer a yield that is potentially higher than the interest on fixed deposits and traditional bonds, the return on investment is limited to the potential yield of individual ELIs.

ELIs are defined as a complex product. ELIs involve derivatives.